- Chart Pattern Recognition Software Metastock Formula 1

- Chart Pattern Recognition Software Metastock Formula

Paid Real Time Data:

ActiveTick.com

Less expensive data comes from ActiveTick.com. The cost is $49.95 a month. They have Forex, US ETFs and US Stocks (No non US markets). For ActiveTick data see http://www.nebadawn.com/AT-Downloader/AT-Downloader.htm

Chart Pattern Recognition Software Metastock Formula Fujitsu Siemens W26361 W69 X 02 Drivers Download Bourne Trilogy 720p. Metastock Formulas Free Download. The advanced software algorithms then search through all of your charts to find the ones with definite patterns, and even the ones in the early stages of a pattern. STEP 2: Begin to focus on specific chart patterns. With a detailed list of the best candidates, now you can begin analyzing individual charts with CPR and MetaStock's Expert Advisor. Here you will find references to the most important chart patterns used in technical analysis. Ascending Triangle.

Xenith by MetaStock.com

More data selection comes from MetaStock's Xenith. They have futures, options, stocks, etfs, foreign markets and everything else.

At this writing, the Xenith cost is $150 a month for the first three months and $150 each month after that. That price is for North American stocks. Prices differ with each market and may have changed. You will need to talk with them.Use the coupon code NEBADAWN to get the discount when you talk with MetaStock about Xenith data.For Xenith data see http://www.ramprt.com/help-files/Xenith-Pattern-Recognition-Scanner.htm

Chart Pattern Recognition Software Metastock Formula 1

We connect Ramp to free real time data wherever we can find it but it is just not available in suitable quality for Ramp.

Chart Pattern Recognition Software Metastock Formula

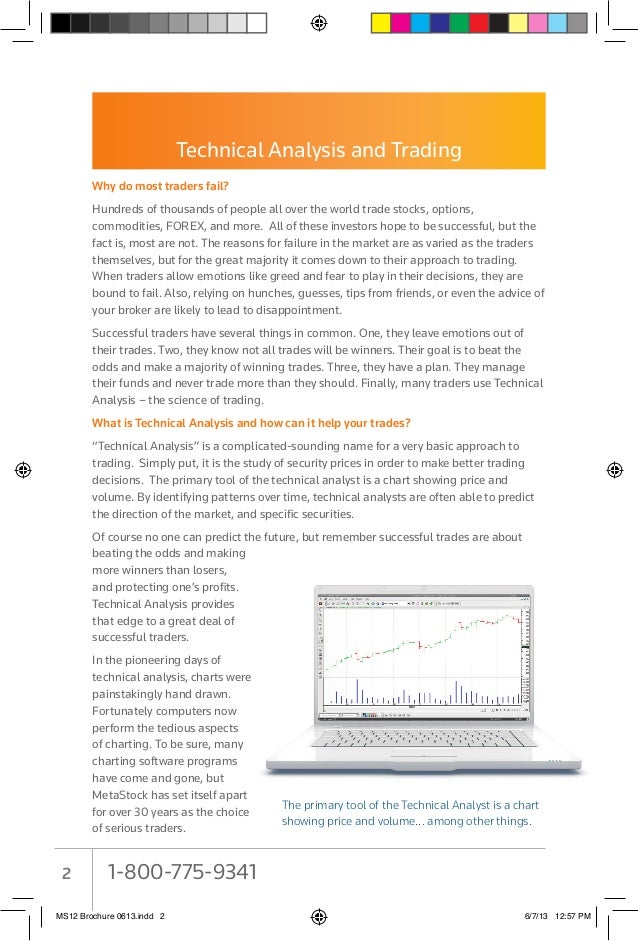

Quick Description. Ichimoku Kinko Hyo is a purpose built trend trading charting system that has been successfully used in nearly every tradable market. It is unique in many ways, but its primary strength is its use of multiple data points to give the trader a deeper, more comprehensive view into price action. This deeper view, and the fact that Ichimoku is a very visual system, enables the trader to quickly discern and filter at a glance the low probability trading setups from those of higher probability. History. The charting system of Ichimoku Kinko Hyo was developed by a Japanese newspaperman named Goichi Hosoda. He began developing this system before World War II with the help of numerous students that he hired to run through the optimum formulas and scenarios analogous to how we would use computer simulated backtesting today to test a trading system. The system itself was finally released to the public in 1. Mr. Hosoda published his book, which included the final version of the system. Ichimoku Kinko Hyo has been used extensively in Asian trading rooms and has been used successfully to trade currencies, commodities, futures, and stocks. Even with such wild popularity in Asia, Ichimoku did not make its appearance in the West until the 1. Youre a position trader. What can MetaStock do for you Our endofday charting software and data are specifically designed for the position or swing trader. MetaStock products and services include charting software, EOD and realtime market data, and 3rd Party Addons for position, swing, and day traders. Stock Screener Chart Pattern Recognition Scanner Scan Forex, Stocks, ETFs, World Markets. Free End of Day Data, also includes Intraday Real Time Scanning and Alerts. Online payment facility Other Payment Options Home Businesses, Agents and Trade Professionals Cargo support, trade and goods Paying invoices to the. English on how to use it, it was mostly relegated to the category of another exotic indicator by the general trading public. Only now, in the early 2. Equilibrium at a Glance. The name Ichimoku Kinko Hyo translates to Equilibrium chart at a glance. Heres how its used. While Ichimoku utilizes five separate lines or components, they are not to be used individually, in isolation, when making trading decisions, but rather used together to form an integrated whole picture of price action that can be gleaned at a glance. Thus, a simple look at an Ichimoku chart should provide the Ichimoku practitioner with a nearly immediate understanding of sentiment, momentum and strength of trend. Price action is constantly measured or gauged from the perspective of whether it is in relative equilibrium or disequilibrium. Hosada strongly believed that the market was a direct reflection of human group dynamics or behavior. He felt that human behavior could be described in terms of a constant cyclical movement both away from and back towards equilibrium in their lives and interactions. Each of the five components that make up Ichimoku provide its own reflection of this equilibrium or balance. The Ichimoku chart is composed of five separate indicator lines. These lines work together to form the complete Ichimoku picture. A summary of how each line is calculated is outlined below The Senkou span A and B deserve special mention here as they, together, form the Ichimoku kumo or cloud. We cover the kumo and its myriad functions in more detail in the kumo section. The chart below FIGURE 1 provides a visual representation of each of these five components Ichimoku Settings. As you can see in the Ichimoku Components section above, each line calculation has one and sometimes two different settings based on the number of periods considered. After much research and backtesting, Goichi Hosoda finally determined that the settings of 9, 2. Ichimoku. He derived the number 2. Chart Pattern Recognition Software Metastock ForumJapanese business month which included Saturdays. The number 9 represents a week and a half and the number 5. The standard settings for an Ichimoku Kinko Hyo chart are 9, 2. There is some debate around whether or not these settings of 9, 2. West does not include Saturdays. In addition, in non centralized markets that do not keep standard business hours like the Forex which trades around the clock, some have posited that there may be more appropriate settings. Nevertheless, EII Capital, as well as most other professional Ichimoku traders, agree that the standard settings of 9, 2. The argument could be made that, since Ichimoku Kinko Hyo functions as a finely tuned, integrated whole, changing the settings to something other than the standard could throw the system out of balance and introduce invalid signals. Recognition, and for much more. Bands are usually thought of as employing a measure of central tendency as a base such as a moving average, whereas envelopes. Tabtight professional, free when you need it, VPN service. MetaStock is an awardwinning charting software market data platform. Scan markets, backtest, generate buy sell signals for stocks, options more. Candlestick pattern. 68. Doji. 89. Hammer candlestick pattern 92. Hanging man candlestick pattern 93. Inverted hammer. 94. Shooting star candlestick pattern. TC2000 Links Worden Brothers, Inc. Activate or Renew TeleChart Service Sign In for FREE Access Try Free 30 Days TC2000 Install Worden Studio Online Training. Issuu is a digital publishing platform that makes it simple to publish magazines, catalogs, newspapers, books, and more online. Easily share your publications and get. Tenkan Sen. The Tenkan Sen, as mentioned, is calculated in the following manner HIGHEST HIGH LOWEST LOW2 FOR THE PAST 9 PERIODSWhile many may compare the tenkan Sen to a 9 period simple moving average SMA, it is quite different in the sense that it measures the average of prices highest high and lowest low for the last nine periods. Hosoda believed that using the average of price extremes over a given period of time was a better measure of equilibrium than merely using an average of the closing price. This study of the tenkan sen will provide us with our first foray into the key aspect of equilibrium that is so prevalent in the Ichimoku Kinko Hyo charting system. Consider the chart in Figure 1 below As can be seen in the chart, the tenkan sen often exhibits flattening whereas the 9 period SMA does not. This is due to the fact that the tenkan sen uses the average of the highest high and lowest low rather than an average of the closing price. Thus, during periods of price ranging, the tenkan sen will clearly show the midpoint of the range via its flat aspect. When the tenkan sen is flat, it essentially indicates a trendless condition over the last 9 periods. It can also be seen how the tenkan sen provides a much more accurate level of price support than does the 9 period SMA. With only one exception, price action stayed above the tenkan sen in the three highlighted areas of the chart, while price broke below the SMA numerous times. This is due to the more conservative manner in which the tenkan sen is calculated, which makes it less reactive to small movements in price. On a bearish chart, the tenkan sen will likewise act as a level of resistance. The angle of the tenkan sen can also give us an idea of the relative momentum of price movements over the last nine periods. A steeply angled tenkan sen will indicate a nearly vertical price rise over a short period of time or strong momentum, whereas a flatter tenkan sen will indicate lower momentum or no momentum over that same time period. The tenkan sen and the kijun sen both measure the shorter term trend. Of the two, the tenkan sen is the fastest given that it measures trend over the past nine periods as opposed to the kijun sens 2. Thus, given the very short term nature of the tenkan sen, it is not as reliable an indicator of trend as many other components of Ichimoku. Nevertheless, price breaching the tenkan sen can give an early indication of a trend change, though, like all Ichimoku signals, this should be confirmed by the other Ichimoku components before making any trading decision. One of the primary uses of the tenkan sen is its relation to the kijun sen. If the tenkan sen is above the kijun sen, then that is a bullish signal. Likewise, if the tenkan sen is below the kijun sen, then that is bearish. The crossover of these two lines is actually a trading signal on its own, a topic that is covered in more detail in the Ichimoku Trading Strategies section. Kijun Sen. The kijun sen is calculated in the following manner HIGHEST HIGH LOWEST LOW2 for the past 2. The kijun sen is one of the true workhorses of Ichimoku Kinko Hyo and it has myriad applications. Like its brother, the tenkan sen, the kijun sen measures the average of prices highest high and lowest low, though it does so over a longer time frame of 2.